The real estate falls in all French-speaking Switzerland

Apartments, villas, PPE. Emerging from a decade of continuous rise, prices reeling under the effect of an increase in supply, Wüest & Partner observes the analyst firm. Lake Geneva Region corrects excesses.

It is now a certainty: 'The boom in the last fifteen years is no longer relevant.' In the latest edition of its 'Monitoring Real' presented Tuesday night, Wüest & Partner could not be more emphatic. The Swiss housing market is stabilizing phase. And the term chosen by the office real estate analysis concerns only the national average. For French-speaking Switzerland, the prices already down clearly. And this trend will continue this year.

In the Lake Geneva region, the price of houses has already declined by 4.5% last year. In 2015, it should still sag 3%, according to Wüest & Partner. In other French-speaking cantons, setbacks will be established between - 0.5% and - 1.5%. Elsewhere in Switzerland, increases are still expected. Only exception Zurich (- 0.3%).

Why these differences, each side of the Sarine? Nothing to do with the language, the correction key 'regions that have experienced the strongest dynamics in recent years', replies Hervé Froidevaux, Partner Wüest & Partner. First referred the shores of Lake Geneva and + 53% in ten years. Here, prices are too high for households to keep pace. The brake effect on demand is all the more clear that the lending conditions have tightened considerably since 2012. Buyers must find half of its capital outside their 2nd pillar. 100 000 francs for a property to 1 million. In addition, the required rate of repayment of loans is now accelerated. In short, they are less likely to be part of the conditions imposed by the banks.

The turnaround therefore also the properties of floors (PPE). They who in a decade, increased 44% nationally, 46% in French-speaking Switzerland and 60% in the Lake Geneva region. This euphoria is well and truly over, insists Wüest & Partner. A logical consequence of the explosion of the offer. In so-called peripheral regions, the number of apartments for sale has tripled since 2004 (see chart).

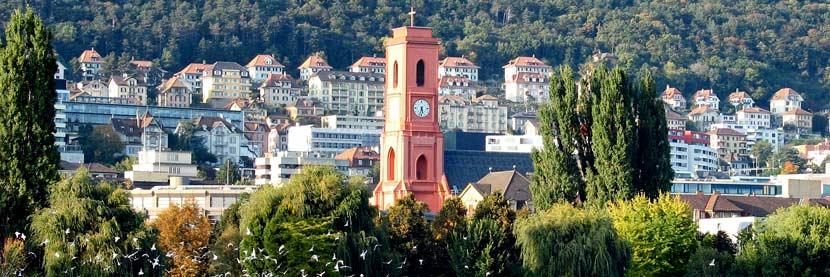

But because prices are still more affordable than those of a villa, demand is somewhat stronger in this segment. Those who no longer have the means to buy the centers are shifting to a rental apartment. And / or are moving to areas where prices still fit their budget. 'Apartment prices in the medium-sized cities remain, while supply continues to increase,' says Hervé Froidevaux. This is particularly the case in Neuchâtel, Fribourg or Sion. By cons, other cities devices are more vulnerable to disappointment. Including those that do not have sufficiently developed transport infrastructure. Part of the Broye Chablais or Gruyere is one of those areas that could end up actually suffer from having too built. Valais eg PPE should lose a small percent value this year. Swiss average, a slight increase of 0.2% is expected this year for apartments.

In the Lake Geneva region, the picture is more homogeneous, the unequivocal verdict. Adverse developments - 2% of PPE in prices is expected in 2015. In Geneva, to - 3.3%. 'The strong liquidity of the market is price pressure,' explains the analysis office. So much so that 'more and more investors are tempted to turn their PPE in buildings with rental units.'

In the rental, however, the outlook is little better for building owners. 'An increasing proportion of new housing has a rent too high in relation to the disposal of tenants to pay' writes Wüest & Partner. This observation is less about the great centers that the regions surrounding them. 'In urban areas, the insertion length has increased. It is almost 40 days, against 30 days in the Swiss average, 'the analysts observe the real estate company.

Finally, this year, new tenants should pay slightly lower rents than in 2014. Across Switzerland.

'More and more investors are tempted to turn their EPP rental properties'

© LeTemps.ch - published on Barnes Suisse on 04/11/2015

Read this article in its integrality by clicking on the following link:

http://www.letemps.ch/economie...